Deel US PEO and Payroll : Streamline Your Payroll Process with Confidence

What is a PEO?

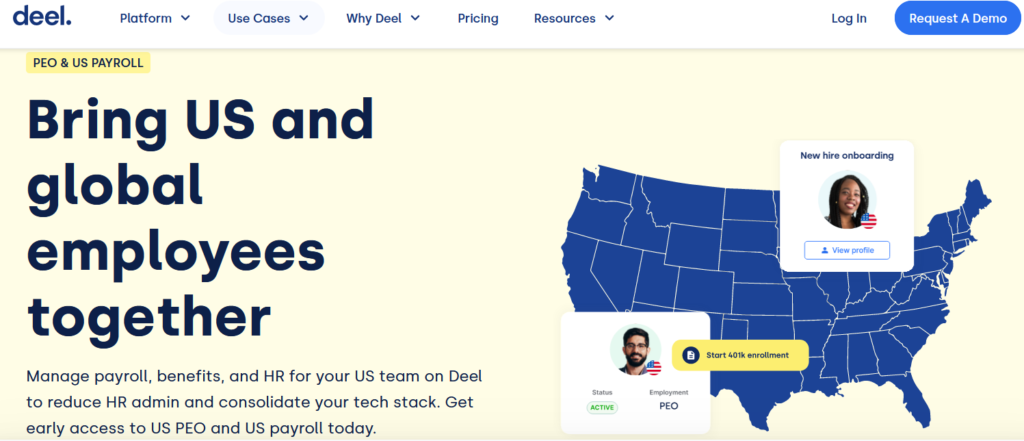

As a business owner, you may have come across the term PEO. PEO stands for Professional Employer Organization, a firm that provides comprehensive HR solutions for small to mid-sized businesses. Partnering with a PEO enables businesses to cost-effectively outsource the management of human resources, employee benefits, payroll, and workers’ compensation, freeing up the business owner’s time to focus on the core business.

PEOs provide services under a co-employment model. This means that the PEO becomes the employer of record for tax purposes, filing paperwork under its own tax identification numbers. However, the client company continues to direct the employees’ day-to-day activities. PEOs charge a service fee for taking over the human resources and payroll functions of the client company: typically, this is from 3 to 15% of total gross payroll.

The PEO model can bring numerous benefits to businesses, from cost savings and administrative efficiency to improved compliance and access to better benefits. However, one area where PEOs can be particularly valuable is in managing payroll, especially for businesses with employees in the US.

Understanding US Payroll

Now that we understand what a PEO is, let’s turn our attention to US payroll. Payroll refers to the process by which employers pay their employees for the work they have done. It involves tracking work hours, calculating pay, withholding taxes and other deductions, and issuing paychecks.

The US payroll system can be notoriously complex, with a myriad of federal, state, and local tax laws to navigate. In addition, there are numerous regulations around wage and hour laws, overtime, and benefits provision that employers must comply with. This complexity can create a significant administrative burden for businesses, especially those with limited HR resources.

Despite its complexity, payroll is a critical function that affects both your business’s bottom line and its relationship with its employees. It requires a high level of accuracy and efficiency to ensure that employees are paid correctly and on time.

The Challenges of Managing US Payroll

Managing US payroll is not just complex, but also time-consuming. Businesses must keep up to date with changing tax laws and regulations, ensure accurate calculation and timely payment of wages, and manage the administrative burden of reporting and compliance. This can divert valuable time and resources away from core business activities.

The risk of errors or non-compliance can also be high. Mistakes in payroll can lead to penalties and fines, not to mention damage to employee relations and company reputation. And with the complexity of US tax laws and regulations, the risk of inadvertent non-compliance is significant.

Furthermore, managing US payroll can be challenging for businesses with a global workforce. Navigating the complexities of international payroll, from currency exchange to differing labor laws, can add another layer of difficulty.

Introducing Deel US PEO and Payroll Services

Deel US PEO and Payroll is a comprehensive solution designed to streamline the payroll process for businesses with employees in the US. Whether you have a small team or a large workforce, it can simplify and automate your payroll process, ensuring accuracy and compliance.

Deel US PEO and Payroll provides a range of services, from wage calculation and disbursement to tax withholding and reporting. It also manages employee benefits and ensures compliance with federal, state, and local labor laws. And with its advanced technology and expert support, Deel US PEO and Payroll can handle the complexities of US payroll with ease.

But Deel US PEO and Payroll is not just about simplifying payroll. It’s also about empowering businesses to focus on what they do best. By taking care of the administrative burden of payroll, Deel US PEO and Payroll frees up time and resources for businesses to invest in their core activities.

Benefits of Using Deel PEO for US Payroll

There are numerous benefits to using Deel PEO for US payroll. Firstly, it simplifies and automates the payroll process, reducing the administrative burden and freeing up time for businesses to focus on their core activities. It also ensures accuracy and compliance, reducing the risk of errors and non-compliance.

Secondly, Deel US PEO and Payroll provides expert support. With a team of HR and payroll experts on hand, businesses can rest assured that their payroll is being managed by professionals with deep knowledge and understanding of US payroll laws and regulations.

Thirdly, Deel US PEO and Payroll is flexible and scalable. Whether you have a small team or a large workforce, it can adapt to your needs. And as your business grows, Deel PEO and payroll can scale with you, ensuring that your payroll process remains efficient and compliant.

How Deel PEO Streamlines Your Payroll Process

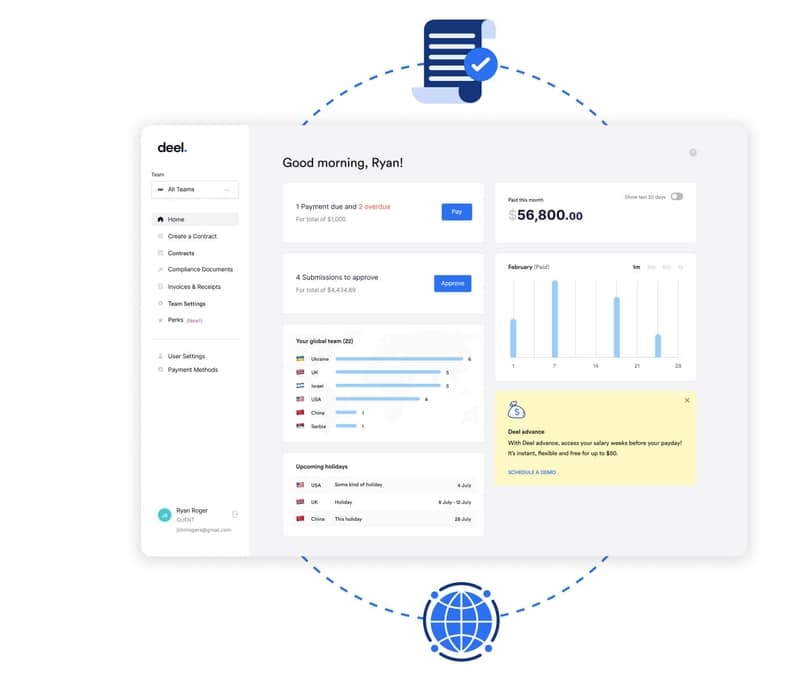

Deel PEO and US Payroll streamlines your payroll process through a combination of advanced technology and expert support. Its platform automates the payroll process, from wage calculation and disbursement to tax withholding and reporting. This not only reduces the administrative burden but also ensures accuracy and compliance.

Deel US PEO and Payroll also manages employee benefits, ensuring compliance with federal, state, and local labor laws. And with its global capabilities, Deel PEO and Payroll can handle the complexities of international payroll with ease.

In addition, Deel US PEO and Payroll provides expert support. With a team of HR and payroll experts on hand, businesses can rest assured that their payroll is being managed by professionals with deep knowledge and understanding of US payroll laws and regulations.

Features and Capabilities of Deel PEO and US Payroll

Deel US PEO and Payroll offers a range of features and capabilities designed to simplify and streamline the payroll process. These include:

- Automated payroll: Automates the payroll process, ensuring accuracy and reducing the administrative burden.

- Tax withholding and reporting: Manages tax withholding and reporting, ensuring compliance with federal, state, and local tax laws.

- Employee benefits management: Deel US PEO and manages employee benefits, ensuring compliance with labor laws and providing employees with access to competitive benefits.

- Expert support: Provides access to a team of HR and payroll experts, providing support and guidance to businesses.

- Global capabilities: Can handle the complexities of international payroll, making it a great solution for businesses with a global workforce.

How to Get Started with Deel US PEO and Payroll

Getting started with Deel US PEO and Payroll is simple. First, you’ll need to get in touch with the Deel team to discuss your needs and how Deel US PEO and Payroll can support your business. You’ll then need to provide some basic information about your business and employees, and the Deel team will take care of the rest.

Once you’re set up, you can start using Deel US PEO and Payroll to manage your payroll process. You’ll have access to the Deel platform, where you can manage your payroll, view reports, and access support from the Deel team. And with Deel PEO and US Payroll taking care of your payroll, you’ll have more time to focus on your core business activities.

Conclusion: Why Deel US PEO and Payroll is the Right Choice for Your Business

In conclusion, if you’re looking for a way to streamline your payroll process and ensure compliance with US payroll laws and regulations, Deel US PEO and Payroll is the right choice for your business.

With Deel, you can automate your payroll process, ensure compliance with all relevant laws and regulations, and free up your time to focus on your core business activities. Deel’s user-friendly platform and team of experts provide the support you need to manage your payroll with confidence.

So why not take the stress out of managing your payroll and let Deel do the heavy lifting? Sign up for Deel US PEO and Payroll today and streamline your payroll process with confidence.

Deel US PEO and Payroll

Frequently Asked Questions about Deel US PEO and Payroll

How easy is it to transition to Deel from my current payroll system?

Transitioning to Deel from your current payroll system can be relatively easy if done correctly. Deel offers self-service functions and automated processes that help streamline and expedite the payroll process

How does Deel ensure compliance with payroll laws and regulations?

Deel streamline payroll processes by using automation to handle tasks such as data entry, calculations, and compliance audits. The Payroll system offers an all-in-one solution for managing payroll across different regions and jurisdictions, ensuring accuracy and compliance.

Can I use Deel PEO if I have employees in multiple countries?

Yes, you can use Deel PEO if you have employees in multiple countries. Deel offers global PEO services that can help you expand into new markets and support your international employees.

What kind of customer support does Deel offer?

Deel offers in-house customer support provided by a dedicated team of professionals from over 31 countries. They prioritize providing exceptional customer experience while keeping up with hyper-growth

How does Deel PEO and US Payroll work?

Deel PEO and US Payroll provides a range of services, from wage calculation and disbursement to tax withholding and reporting. It also manages employee benefits and ensures compliance with federal, state, and local labor laws.