Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission, Learn More

Augusta Precious Metals Review: A Leading Provider of Gold IRAs

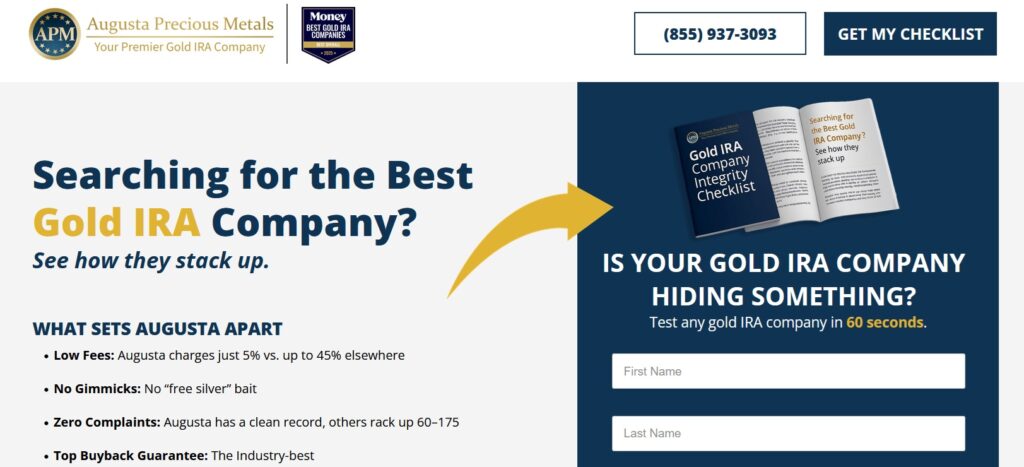

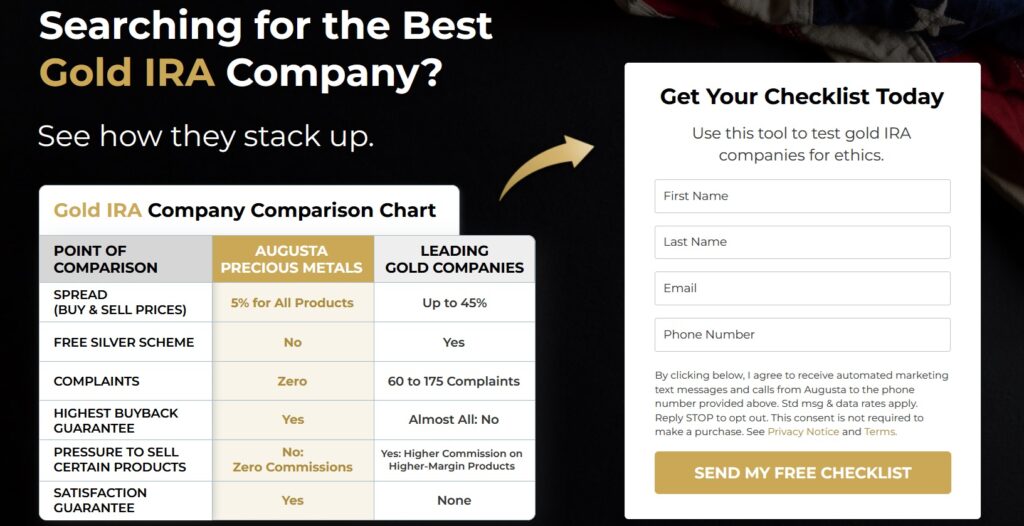

Augusta Precious Metals Stands Apart from Other Leading Gold IRA Companies, Test any gold IRA company in 60 seconds.

If you’re considering investing in precious metals for your retirement, Augusta Precious Metals is a well-known provider of gold and silver IRAs. In this review, we’ll explore the key features, benefits, and considerations of Augusta Precious Metals to help you make an informed decision.

What Sets Augusta Precious Metals Apart

Established in 2012, Augusta Precious Metals is based in Casper, Wyoming. The company specializes in precious metals and primarily serves high-net-worth individuals and retirees, with a minimum investment requirement of $50,000.

Augusta Precious Metals differentiates itself in the industry through its focus on customer education and support. One of their core offerings is a personalized approach to guiding clients in understanding gold and silver IRAs. Upon engagement, you’ll have access to a one-on-one web session to learn about precious metal investments and potential risks.

The company also provides a variety of educational materials on their website, including videos and weekly articles, which help customers stay informed about the market and make better investment decisions.

Additionally, Augusta Precious Metals emphasizes customer support. Once you become a client, you gain access to their team of professionals who can assist with various aspects of your IRA, including adding more precious metals or managing distributions during retirement. The company’s approach centers on providing long-term support throughout your investment journey.

Benefits of Investing with Augusta Precious Metals

1) Account Lifetime Support

One key advantage of choosing Augusta Precious Metals for your gold IRA is their lifetime support. You’ll be assigned a dedicated agent to guide you through your investment, answer questions, and connect you with other specialists as needed. This ensures that you have ongoing assistance and can address any concerns as they arise.

2) Educational Resources

Augusta Precious Metals places a strong emphasis on providing educational content to its customers. With resources like one-on-one web sessions and their “Ultimate Guide to Gold IRAs,” they ensure clients have a solid understanding of precious metals investments. Additionally, the company’s video library covers various topics, from basic concepts to strategies for managing your portfolio during retirement.

3) No-Pressure Sales Approach

Augusta Precious Metals adopts a no-pressure sales approach. They prioritize customer education over aggressive sales tactics, aiming to help you make informed decisions based on your retirement needs, rather than pushing for immediate action.

4) Reputation

Augusta Precious Metals is well-regarded in the industry, with an A+ rating from the Better Business Bureau (BBB), AAA from Business Consumer Alliance (BCA) and positive reviews from customers on platforms like Trustlink and Consumer Affairs. Their focus on professionalism and customer service has contributed to their solid reputation among investors.

Gold IRA Solutions with Augusta Precious Metals

Augusta Precious Metals offers a variety of services for those looking to include gold and silver in their retirement plans. Below are the key features of their gold IRA offerings:

- IRA-Compliant Precious Metals

Augusta Precious Metals provides a selection of IRA-compliant precious metals, including gold and silver coins and bars. These products meet the IRS standards for IRAs, with gold typically requiring a purity of at least 99.5% and silver 99.9%. This ensures that your investments are compliant with IRS regulations. - Direct Purchase of Gold and Silver

The company allows customers to directly purchase gold and silver for their IRA. Clients can choose from a variety of options, such as American Eagles, Canadian Maple Leafs, and Australian Kangaroos, as well as different-sized bars. This flexibility allows you to tailor your investments according to your goals. - Secure Storage in IRS-Approved Depositories

To ensure the safety of your investments, Augusta Precious Metals partners with IRS-approved depositories for storage. These facilities are equipped with high-security features, including 24/7 surveillance, and come with insurance coverage. Augusta covers shipping and liability insurance costs until your metals are securely stored. - Lifetime Support

Once your gold IRA is set up, you’ll continue to receive support from Augusta Precious Metals. This includes ongoing assistance with market updates, account management, and distribution strategies during retirement.

Transparent Fees and Low Spreads Add Value to Your Gold IRA

Augusta Precious Metals offers a low spread of about 5% on IRA-approved gold bullion, such as American Gold Eagles and Canadian Maple Leafs. This spread—among the lowest in the precious metals IRA industry—is disclosed upfront, so investors know exactly what they’re paying, with no hidden fees or surprises. Augusta focuses solely on investment-grade bullion and does not offer proof or collectible coins in IRAs, which often carry much higher markups at other firms.

In addition to low spreads, Augusta maintains a clear and straightforward fee structure:

-

Setup Fee: $50 one-time fee to establish your Gold IRA

-

Annual Maintenance Fee: $200 per year, covering custodial services and secure storage

-

No Hidden Fees: No liquidation or unexpected charges

This transparency helps investors:

-

Understand the true cost of their investment

-

Avoid high-markup products like proof coins

-

Plan their retirement strategies more confidently

Many companies do not fully disclose their spreads upfront, often revealing higher markups later or promoting costly proof and collectible coins without clear explanation. Augusta stands out by sharing all fees and spreads upfront, helping clients make informed, confident decisions.

Visit Augusta to access your free Gold IRA checklist, which covers all the key details to consider before opening a precious metals IRA.

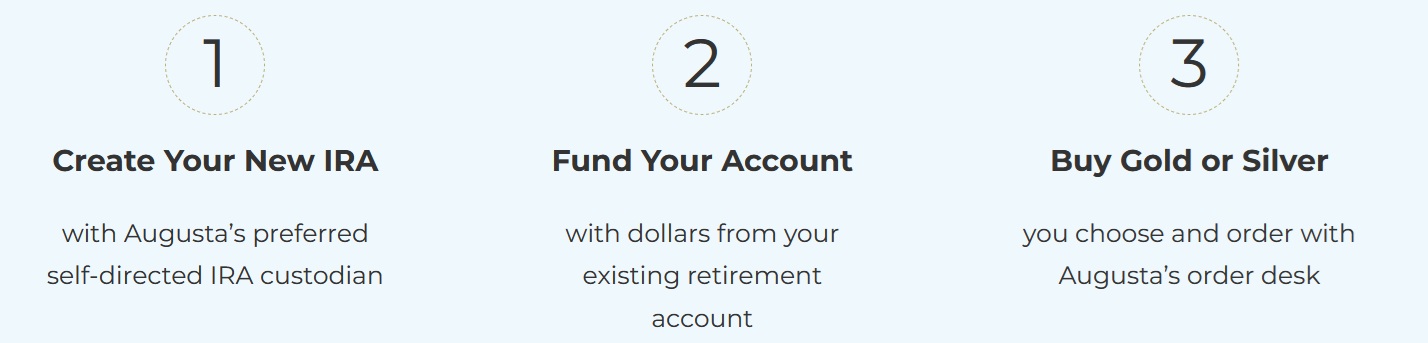

How to Open a Gold IRA with Augusta Precious Metals

Opening a gold IRA with Augusta Precious Metals is a straightforward process:

1) Research and Gather Information

Begin by researching Augusta Precious Metals. Explore their website and read independent reviews ( BBB, BCA) to familiarize yourself with their offerings and customer experiences.

2) Understand the Benefits and Risks

Before making any decisions, it’s important to understand the potential benefits and risks of investing in gold IRAs. Augusta Precious Metals provides educational resources to help you make informed decisions.

3) Contact Augusta Precious Metals

Once you feel ready, Request a Free comparison checklist or contact Augusta Precious Metals by phone at 855-937-3093. A representative will guide you through the next steps.

4) Consultation and Guidance

During your consultation, you will receive personalized advice based on your investment goals. You can ask questions and ensure that you understand the process before moving forward.

5) Set Up Your IRA Account

After your consultation, you will complete the necessary paperwork to set up your gold IRA account. This will include providing identification and designating beneficiaries.

6) Fund Your IRA

Once your account is set up, you will need to fund it by transferring funds from an existing retirement account or contributing new funds. Augusta Precious Metals will guide you through the funding process.

7) Choose Your Precious Metals

After funding your IRA, you can select the specific gold and silver products for your portfolio. Augusta will help you understand your options to align with your investment strategy.

8) Storage and Administration

Once you’ve selected your metals, Augusta Precious Metals will arrange for secure storage in an IRS-approved depository. They handle all administrative tasks, such as record-keeping and reporting.

9) Ongoing Management and Support

After your account is set up, Augusta Precious Metals continues to provide ongoing management and support. You can reach out for assistance with market updates, portfolio changes, or other account-related matters.

How Augusta Precious Metals Stands Out Among Gold IRA Providers

Based on the comparison of BBB and BCA complaint data, Augusta Precious Metals stands out for having zero complaints reported with either organization, while still maintaining the highest available ratings (A+ with BBB and AAA with BCA). This may reflect consistent customer satisfaction and strong issue resolution processes.

While several companies in the table also maintain high ratings and relatively low complaint counts, Augusta’s clean record is notable, especially in an industry where transparency and trust are essential.

If you’re currently researching gold or silver IRAs and want to make an informed decision, we recommend downloading Augusta Free Comparison Checklist. It provides clear, non-promotional guidance on what to look for in a gold IRA company — including fees, product transparency, and customer support.

| Company | BBB Rating | BBB Complaints | BCA Rating | BCA Complaints |

|---|---|---|---|---|

| Augusta Precious Metals | A+ | 0 | AAA | 0 |

| Noble Gold | A+ | 4 | AAA | 0 |

| American Hartford Gold | A+ | 65 | AAA | 2 |

| Rosland Capital | A+ | 78 | AAA | 2 |

| Goldco | A+ | 59 | AAA | 0 |

| Lear Capital | A+ | 30 | AAA | 6 |

| Birch Gold | A+ | 8 | AAA | 0 |

Note:

The Better Business Bureau (BBB) is an organization that helps people find trustworthy businesses. It looks at how companies handle customer service and complaints to give them a rating that shows how reliable they are.

The Business Consumer Alliance (BCA) is another group that reviews companies based on honesty, service quality, and how well they solve customer problems. It helps consumers choose businesses they can trust.

Conclusion

Augusta Precious Metals offers a reliable platform for individuals seeking to diversify their retirement portfolios with gold and silver. With a strong emphasis on education, customer support, and transparent business practices, the company provides a solid option for those interested in precious metal IRAs. Their approach focuses on providing clients with the tools and resources they need to make informed decisions while offering lifetime support for the duration of their investments. If you’re considering adding gold or silver to your retirement strategy, Augusta Precious Metals is a reputable choice to explore.

| Min Investment: $50,000 | One time setup fee : $50 |

| Preferred Storage: Delaware Depository | Annual fee : $200 |

| Custodian: Partners with Equity Trust | Promotions: Zero fees for up to 10 years (based on investment amount) |

Check out these no-cost resources available from Augusta Precious Metals:

Pros

1. Excellent Customer Service

2. Strong Educational Focus

3. Transparent Fee Structure

4. Highly Rated by Third Parties

5. Lifetime Customer Support

Cons

1. High Minimum Investment

2. Focuses on Gold and Silver only

Download Your Free Gold IRA Checklist

Ready to explore gold as a retirement investment? Use this simple, step-by-step checklist to guide your research and find the right Gold IRA for your financial future.

Gold IRA Company Checklist

Frequently Asked Questions

What is a self-directed IRA

A self-directed IRA allows you to invest in alternative assets like precious metals, real estate, crypto, and private equity—unlike traditional IRAs limited to stocks and bonds.

What are the main benefits of a Gold IRA rollover or transfer?

A Gold IRA rollover or transfer allows you to move retirement funds into a tax-advantaged account backed by physical gold—offering diversification, inflation protection, and a hedge against economic instability.

How does Augusta Precious Metals assist with the IRA rollover process?

What are the storage options for my metals?

Gold IRA metals must be stored in approved depositories, either in segregated (stored separately) or non-segregated (pooled with others’) storage.

What is the difference between a rollover and a transfer? Which is better?

-

Rollover: You receive the funds and redeposit them within 60 days.

-

Transfer: Custodians move funds directly.

A transfer is usually safer and easier, with less risk of penalties.

Can I roll over funds into a Gold IRA without paying taxes or penalties?

A direct rollover from another retirement account (such as a 401(k) or Traditional IRA) into a Gold IRA is typically tax-free and penalty-free, as long as you follow the rollover rules, like completing it within 60 days.

Augusta Free Gold IRA Kit

The most effective way to start learning about gold and silver IRAs, as well as Augusta Precious Metals, is to request a complimentary gold IRA kit from the company.

Since its founding in 2012, Augusta Precious Metals has maintained a strong reputation with no complaints reported. This track record of reliability makes it a company we confidently recommend.

or Call 855-937-3093

Disclaimer : The information provided in this content is for informational purposes only. Consult with a financial professional before making any investment decisions.