Disclosure: We are reader-supported, which means we may earn money from our partners when you click a link, complete a purchase. Learn More

To file for a refund on your 2021 taxes, you have until April 15, 2025.

Are you a self-employed worker navigating the financial challenges brought on by the impact of the COVID-19 pandemic? You deserve every dollar of the tax credits available to you! The Families First Coronavirus Response Act (FFCRA) provides eligible self-employed individuals like you with crucial tax credits that can significantly alleviate financial stress. Fintitan is designed to streamline the entire process, making it simple and hassle-free for you to claim the refund you deserve.

Why Choose Fintitan?

Fintitan is a specialized online platform designed to help self-employed individuals navigate the process of claiming tax credits, particularly those available under the Families First Coronavirus Response Act (FFCRA). The platform aims to simplify the often complex tax refund process, making it easier for freelancers, contractors, and small business owners to access the financial relief they deserve.

For self-employed individuals looking to claim tax credits, Fintitan provides a straightforward and supportive solution. With expert guidance and a focus on maximizing refunds, it helps users take control of their financial future with confidence.

User-Friendly Platform: Fintitan’s intuitive interface is designed with you in mind. You don’t need to be a tax expert to navigate our system. The platform guides you through each step, allowing you to focus on what matters most—your business.

Expert Support: Tax regulations can be intricate and ever-changing, especially for self-employed workers. Fintitan team of experienced tax professionals is available to assist you. Whether you have questions about eligibility, documentation, or the filing process, They’re here to help.

Maximize Your Refund: Many self-employed individuals leave money on the table simply because they don’t know what they qualify for. Fintitan ensures you claim every dollar you’re entitled to, giving you confidence that you’re getting the maximum benefit.

Fast Processing: Fintitan is committed to quick turnaround times for tax refunds, allowing users to receive their funds as promptly as possible.

Transparent Fees: The platform charges a 20% processing fee based on the total refund, along with a $97 non-refundable verification fee, ensuring transparency about costs.

What Is the Self-Employed Tax Credit Refund?

The FFCRA was enacted to provide relief to businesses and individuals affected by the pandemic. As a self-employed worker, you may be eligible for tax credits that help offset lost income due to circumstances related to COVID-19. Here are some key aspects of the Self-Employed Tax Credit Refund:

Who Is Eligible?: If you are self-employed and experienced a decline in business due to COVID-19 or had to care for a family member impacted by the virus, you may qualify for tax credits. Eligibility is based on your income, the nature of your work, and specific circumstances.

What Are the Benefits?: The credits can help cover a portion of your lost income and allow you to continue operating your business. This financial support is crucial for maintaining stability during uncertain times.

How Much Can You Claim?: Up to $32,000, The amount you can claim varies based on your specific situation, including your income level and the duration of your eligibility. Working with Fintitan ensures that you receive the maximum refund possible.

The Fintitan Process

Using Fintitan is designed to be simple and efficient. Here’s a step-by-step guide to how the process works:

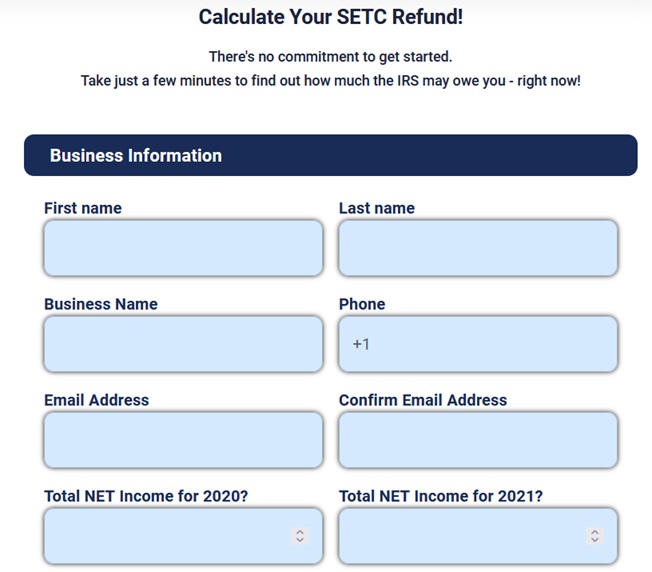

Sign Up: Start by visiting https://setc.fintitan.com/ and creating your account. The sign-up process is quick and requires minimal information

Provide Your Information: Once you’re registered, you’ll need to input details about your self-employment status, income, and the circumstances that led to your eligibility for the tax credit.

Upload Documentation: Fintitan will prompt you to upload any necessary documents. This could include tax returns, income statements, and records of any business disruptions you experienced. The platform makes it easy to securely upload files.

Review and Submit: After you’ve entered your information and uploaded your documentation, Fintitan team will review your submission to ensure everything is accurate and complete. They’ll notify you if need any additional information.

Receive Your Refund: Once your claim is processed, you’ll receive your refund quickly. Fintitan streamlines the process to minimize waiting times, so you can get back to focusing on your business.

Common Questions About the Self-Employed Tax Credit Refund

You may have some questions about the process or eligibility. Here are answers to some frequently asked questions:

1) How do I know if I’m eligible for the self-employed tax credit?

Eligibility typically depends on factors such as your income, the nature of your work, and the impact of COVID-19 on your business. Fintitan can help assess your situation and determine your eligibility.

2) What documents will I need to provide?

You’ll need to provide documentation such as tax returns, income statements, and any records related to business disruptions or caregiving responsibilities. Fintitan will guide you through the required documents.

3) How long does it take to receive my refund?

Fintitan aims to process your claim as quickly as possible. Once your submission is complete and accurate, refunds are typically issued within a few weeks, depending on processing times.

4) Is my information secure with Fintitan?

Fintitan prioritizes your security. We use advanced encryption and data protection measures to keep your information safe throughout the entire process.

Take Control of Your Financial Future

If you’re a self-employed worker, it’s essential to take control of your financial future. The self-employed tax credit refund is an opportunity for you to secure the funds you need to keep your business running smoothly. Fintitan is dedicated to making this process as straightforward as possible.

Act Now!

The sooner you act, the sooner you can unlock your self-employed tax credit refund. Don’t leave money on the table—join countless other self-employed individuals who have trusted Fintitan to help them secure their financial relief.

Visit https://setc.fintitan.com/ today and start your journey toward claiming the refund you deserve.

Conclusion

Navigating the world of taxes can be challenging, especially for self-employed workers. However, with Fintitan, you have a trusted partner to help you through the process. Fintitan commitment to simplicity, expert guidance, and maximizing your refund means you can focus on what you do best—growing your business.

Don’t let the complexities of tax credits hold you back. Take the first step today, and let Fintitan assist you in claiming the self-employed tax credit refund you’ve earned. Your financial future is waiting!

Get Up To $32,200 Back

P/S : Visitors searching for SETC have also shown interest in the ERTC application, which offers up to $21,000 per employee, available only until April 15th 2025.