Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission, Learn More

How do I choose the best Gold IRA company?

Diversifying retirement savings with physical gold or silver has become increasingly popular among investors seeking long-term stability. A Gold IRA (individual retirement account) allows you to hold IRS-approved precious metals within a tax-advantaged account, offering potential protection against inflation, currency weakness, and market swings.

But the Gold IRA market has grown crowded, and not every provider operates with the same level of transparency or investor focus. Understanding how to choose the right company is essential before you move any funds.

This guide outlines what to look for, how to compare options, and why Augusta Precious Metals is frequently mentioned among credible providers in the industry.

Understanding How a Gold IRA Works

A Gold IRA is a self-directed IRA that allows physical metals—gold, silver, and sometimes platinum or palladium—instead of only paper assets such as stocks or funds.

To stay compliant with IRS rules, you’ll need:

-

An IRS-approved custodian to administer the account and handle reporting.

-

An approved depository to store your physical metals securely.

-

Eligible bullion that meets IRS fineness and form standards (for example, gold .995 fine, silver .999 fine).

You cannot personally store the metals owned by your IRA without triggering a taxable distribution. Because of these additional rules, Gold IRAs generally carry higher fees than traditional IRAs—but can also provide diversification that some investors find valuable.

Key Criteria When Comparing Gold IRA Companies

a) Reputation and Trust

Start by researching each company’s background:

-

Check independent ratings (BBB, Trustpilot, Business Consumer Alliance).

-

Look for a clear history of resolving complaints and transparent communication.

-

Verify how long the company has operated and whether it has a clean regulatory record.

b) Fees and Pricing

Common costs include:

-

Account setup ($50–$150)

-

Annual custodian and storage fees ($100–$300 total)

-

Dealer mark-ups on metals above the spot price

Ask for a complete written fee schedule. Avoid firms that won’t disclose all costs upfront.

c) Custodian and Depository

Confirm which custodian and vault will hold your assets.

Questions to ask:

-

Is storage segregated (your metals kept separate) or commingled?

-

What insurance covers the holdings?

-

Can you visit or verify the depository location?

d) Eligible Metals and Liquidity

Ensure the company only sells IRS-approved bullion or coins.

Check its buy-back policy so you understand how to liquidate or take distributions later.

e) Transparency and Education

Trustworthy providers focus on education over sales pressure.

They should clearly explain:

-

The full rollover process

-

IRS rules and timelines

-

All fees, mark-ups, and storage arrangements

f) Minimum Investment

Some Gold IRA firms set minimums from $10,000 to $50,000 or more.

Select one that fits your portfolio size and risk tolerance.

g) Red Flags

Be cautious of:

-

Collectible-coin promotions

-

Home-storage promises (usually non-compliant)

-

High-pressure or fear-based sales scripts

-

Hidden or variable fees not listed in writing

Why Augusta Precious Metals Is Often Highlighted

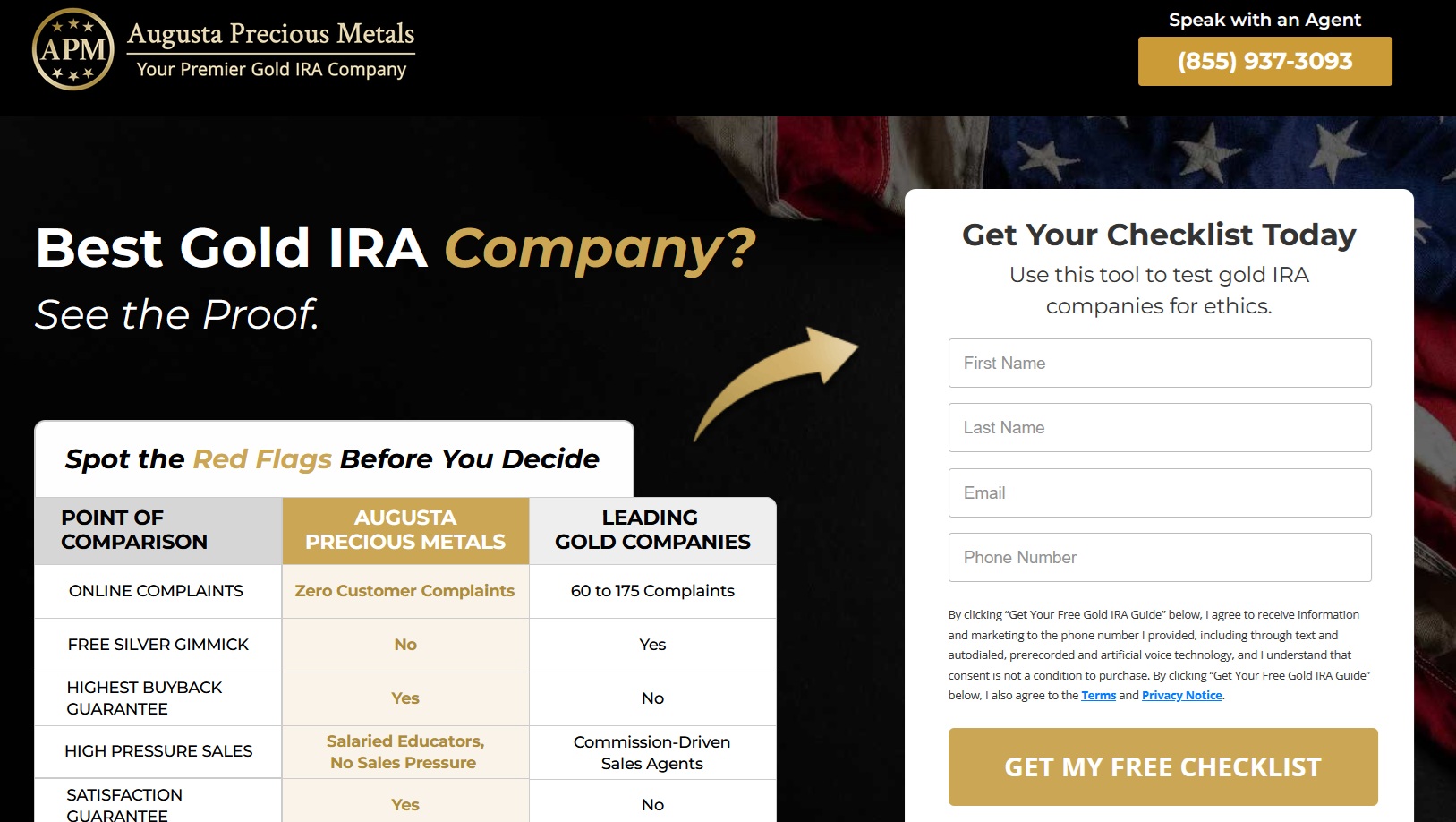

While you should evaluate several options, many investors cite Augusta Precious Metals (APM) as a reliable choice based on transparency and education. Below is an overview of public information and common feedback.

Reputation and Reviews

APM maintains strong ratings—4.9 / 5 average on major review platforms such as Trustpilot and the BBB. Independent reviewers consistently note its clear communication and helpful customer support.

The company has operated since 2012 and is known for its no-commission, salaried-advisor model, which helps reduce sales pressure.

Education-First Approach

Rather than leading with product pitches, Augusta provides:

-

Free educational web conferences and guides

-

One-on-one sessions explaining Gold IRA mechanics

-

Written disclosure of fees and spreads before any purchase

This focus on investor education makes it easier for clients to decide at their own pace.

Fee Structure and Minimums

Industry listings report a $50,000 minimum to open an account.

Typical costs include roughly $50 setup and around $100 each for annual custodian and storage fees—competitive within the sector. Some promotions waive administrative fees for larger accounts, but always confirm current terms directly with the company.

Customer Experience

Client reviews frequently mention responsive service and clear guidance through rollovers.

Because staff are salaried, not commission-based, the tone of communication tends to be educational rather than aggressive.

Suitability

Augusta may appeal to investors who:

-

Plan to allocate at least $50,000 toward metals

-

Prefer comprehensive education and transparent pricing

-

Want long-term diversification rather than short-term trading

Comparison Checklist

When evaluating any provider, consider building a side-by-side table like this:

| Feature | Questions to Ask | Augusta Precious Metals | Other Provider |

|---|---|---|---|

| Setup / annual fees | What’s the total yearly cost? | ≈ $200–$250 combined | |

| Storage type | Segregated or commingled? | Disclosed, segregated option | |

| Custodian partner | Which firm handles the IRA? | Equity Trust / other approved custodian | |

| Minimum investment | Entry threshold? | $50,000 | |

| Education | Free consultations & materials? | Yes | |

| Buy-back policy | Transparent terms? | Yes | |

| Sales model | Commission-based? | Salaried advisors |

Using a structured comparison like this highlights differences that may not be obvious at first glance.

Mistakes to Avoid

Even diligent investors can slip on the following:

1.Buying collectible or numismatic coins that aren’t IRA-eligible.

2.Over-allocating retirement funds to metals without considering overall diversification.

3.Skipping written fee confirmation.

4.Believing all storage is the same. Segregated storage generally costs more but offers clearer ownership.

5.Falling for urgency tactics. Markets move daily, but long-term retirement decisions shouldn’t be rushed.

Steps to Take Before You Invest

1.Research three or more companies. Read verified reviews and regulatory records.

2.Request written materials. Download each provider’s guide or fee disclosure.

3.Call and ask detailed questions about custodian, storage, and mark-ups.

4.Compare side-by-side. Use your checklist to evaluate transparency and support.

5.Consult a financial or tax professional to confirm suitability and rollover strategy.

6.Proceed carefully with a trustee-to-trustee transfer so your rollover remains tax-free.

Final Thoughts

Choosing the right Gold IRA company is about more than finding the lowest fees. Look for reputation, clarity, and education—qualities that help protect your retirement savings over the long term.

Augusta Precious Metals is one example of a company that receives consistently positive reviews for its transparency and service model. Still, investors should compare multiple options, verify all costs, and confirm that a Gold IRA aligns with their overall financial plan.

A measured, informed approach will help ensure your precious-metals investment complements—rather than complicates—your retirement strategy.

Free Gold IRA Company Checklist

Download a free Gold IRA Company Checklist to compare fees, reputation, and storage options. Make informed choices before investing in precious metals for retirement.

This content is for informational and educational purposes only and does not constitute financial, investment, or tax advice. Investing in precious metals involves risk and may not be suitable for all investors. Always consult a licensed financial or tax professional before opening or transferring any IRA account.